Data-Driven Site Selection Models

In today’s competitive retail environment, selecting the right site is a high-stakes decision. The wrong location can derail revenue projections and delay market growth. While most retailers now incorporate data into their process, the difference between success and stagnation often lies in how well that data is structured, synthesized, and applied.

Modern site selection models go far beyond demographics or broker input. They integrate layered datasets—mobility trends, lifestyle segmentation, competitive mapping—into a unified strategy that drives confident, profitable decisions.

Trade Area Redefined: Moving Beyond Radius Circles

Fixed-radius trade areas (3-mile, 5-mile) offer limited insight into real consumer behavior. Today’s models define trade areas based on drive times, walkability, and behavioral clusters, offering a more precise view of true customer reach.

Application: A grocer evaluating two suburban sites could compare weekday traffic from nearby employment centers. Mobile location data may reveal that one site draws heavy lunch traffic—an insight a static map wouldn’t show.

Tools used: ESRI Business Analyst, MapInfo, Placer.ai

Demographics Are Just the Beginning

Basic population stats aren’t enough. Psychographics and lifestyle segmentation reveal why people shop, how often, and where.

Example tools: Claritas PRIZM and Nielsen Segmentation sort consumers into lifestyle groups that align with retail behaviors—ideal for tailoring store formats and merchandising strategies.

Competitive Landscape + Cannibalization Modeling

Data-driven models account for surrounding retailers and potential cannibalization of your existing stores. Retailers use gravity models or market share forecasting to simulate trade area overlaps.

Application: A restaurant brand comparing multiple sites might model expected trade area overlap to avoid eroding traffic from an existing location.

Real-Time Mobility & Traffic Trends

Using mobile device data, retailers now map dwell times, foot traffic patterns, and directional flows. This helps determine if a location supports quick visits, lingering shoppers, or peak-hour volume.

Stat to know: According to Placer.ai’s 2024 report, shopping centers with complementary co-tenancy (like fitness + coffee + grocery) experience up to 22% longer visit durations.

Predictive Sales Modeling & Forecasting

Advanced site selection models forecast performance before a lease is signed. Inputs include:

- Historical comps

- Co-tenancy impact

- Seasonal patterns

- Customer spending power

Outputs may include:

- Forecasted sales per square foot

- Payback timelines

- IRR and breakeven scenarios

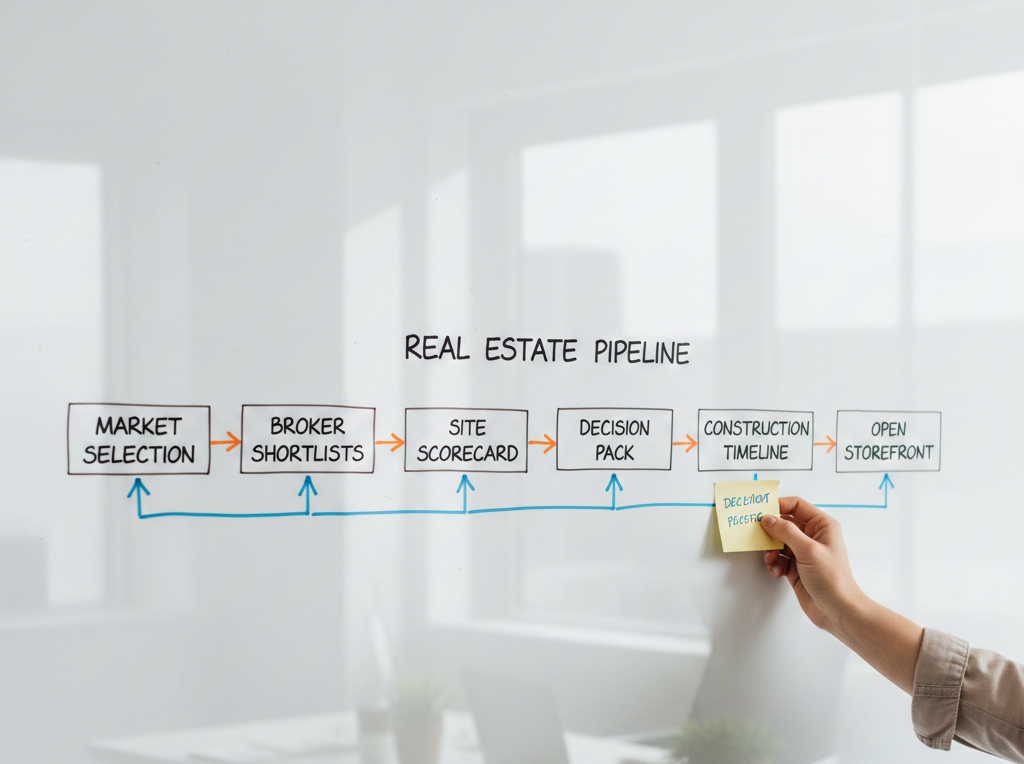

Scorecards and Visual Decision Support

Weighted scorecards help retail teams objectively compare candidate sites based on brand-specific criteria such as rent, access, visibility, and tenant synergy. Visual dashboards or GIS heatmaps are often used to prioritize options.

Application: A retailer planning regional expansion could assign scores to 8 locations and quickly narrow to the top 3 based on total weighted impact.

Internal Buy-In: Turning Analysis into Action

Strong analytics lose impact without strong presentation. Retailers use dashboards, maps, and scenario models to help real estate, finance, and operations align on decisions quickly.

The result: faster executive sign-off and reduced friction between departments.

Common Pitfalls to Avoid

Even sophisticated models can mislead if applied incorrectly:

- Averages hide extremes. Median income may overlook high-income pockets or underserved zones.

- Zoning or permitting delays are often unmodeled but can derail timelines.

- Data silos between departments can lead to missed operational or financial realities.

Common Tools in Modern Site Selection

Retailers often combine platforms to form their decision stack:

- GIS & Mapping: ESRI, MapInfo

- Mobility & Traffic: Placer.ai, SafeGraph

- Retail Intelligence: Buxton, ChainXY

- Real Estate Databases: Crexi, Reonomy

These tools help bring demographic, behavioral, and market data into one decision-making framework.

Bringing It All Together: Why Outside Expertise Matters

Even with strong internal teams and access to quality data, many retailers face gaps in turning insight into action. That’s where an experienced external partner can deliver real advantage—not just by connecting the data, but by guiding strategy, refining execution, and ensuring alignment across departments.

At CRE 360, we help clients at every stage of the site selection process:

- Strategic Planning: We identify untapped trade areas, define custom scoring frameworks, and align expansion targets with brand priorities and capital constraints.

- Data Synthesis: We bring together disparate sources—mobility, demographics, co-tenancy, financial thresholds—into a unified decision model that reflects how your business really operates.

- Interpretation & Communication: We translate complex analytics into executive-ready visuals and narratives that make the case to internal stakeholders, boards, or capital partners.

- Execution Support: From validating landlord claims to collaborating with municipalities or brokers, we help teams avoid friction and accelerate timelines.

Whether you’re entering a new market or optimizing your national rollout, expert support ensures your team moves forward with clarity, confidence, and competitive precision.

From Location to Leadership

A well-structured, data-driven site selection model doesn’t just help you choose—it helps you lead. It cuts risk, supports stakeholder buy-in, and positions your brand for sustainable growth.

📥 Ready to elevate your site selection strategy? Request an Expert Review

Ready to Elevate Your Strategy?

Schedule a consultation today to discuss your project and see how we can help you achieve your goals.

Stay Updated with CRE 360

Get the latest insights and updates from CRE 360 in your inbox.